Language

- English

- Română

Currency

- $ USD

- € EUR

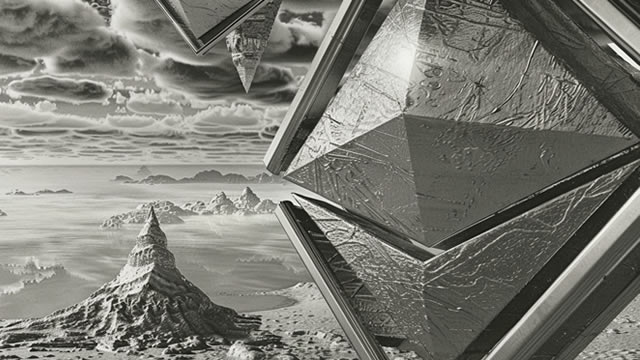

Oldies but Goodies: Should You Still Be Investing in Ethereum, XRP, or Chainlink in 2025?

More News Articles

Expert Predicts Bitcoin and Ethereum Could Reach Unprecedented Heights by 2027

Cryptocurrency analyst Michaël van de Poppe has shared a bold prediction with his 768,800 followers on X (formerly Twitter), suggesting that Bitcoin (BTC) and Ethereum (ETH) could experience incredible growth in the coming years. According to van de Poppe, Bitcoin might soar as high as $500,000 and Ethereum could reach $20,000, signaling a market cycle unlike any we've seen before.

How This Ethereum Whale Made $16.8M Profit Shorting ETH

An Ethereum whale managed to mint a staggering $16.8 million by going short on ETH price ahead of today's 5% correction. Amid today's broader market sell-off, ETH tanked to $3,050 once again, triggering over $81 million in long liquidations.

Bitcoin, ETH, & XRP Price Prediction: Will the Bulls Regain Dominance?

The crypto market has displayed a strong bearish price action overnight. Following this, top crypto tokens have plunged below their important support levels. Moreover, Bitcoin, Ethereum, and Ripple tokens have recorded a similar price action, resulting in increased bearish sentiment.

Ethereum trader earns $16M as ETH price falls to $3K

Some cryptocurrency traders are profiting millions from Ether's six-week downtrend despite the heightened risks of leveraged trading.

Ethereum Remains Largely Uncorrelated To Bitcoin – Data Shows ETH Tied To Other Coins

Ethereum (ETH) has been under intense selling pressure, raising concerns among investors about the coming weeks. The trend remains bearish, and if this momentum continues, ETH could struggle to find support at key levels.

Ethereum Crosses $3,400 As Trump's World Financial Liberty Buys More ETH

Ethereum (ETH) surged past $3,400 today, marking the second consecutive day that the digital asset has outperformed Bitcoin (BTC) in price action. Meanwhile, Donald Trump-linked decentralized finance (DeFi) project, World Financial Liberty (WFL), continues to accumulate more ETH.

Crypto Market Bloodbath: XRP Under $3, BTC, SOL, ETH and DOGE See Major Losses

The cryptocurrency market is currently struggling, with the majority of the top 10 altcoins seeing major declines. While Bitcoin (BTC) has shown some resilience, many altcoins are in the red, leading to a general feeling of uncertainty among investors. Bitcoin, the market leader, is priced at $99,780, showing a slight 2.

Ethereum Price Analysis: Vitalik's Network Updates Disrupt ETH Markets as Whale Demand Plunges 22% in January 2025

Ethereum price plunged below $3,150 on Saturday Feb 1 as crypto markets retreated after a volatile week, on-chain data trends suggest declining whale demand for ETH could exacerbate the market dip in the days ahead. Ethereum Price Struggling to Hold $3,100 Amid Market Retreat Ethereum (ETH) faced a sharp downturn on Saturday, mirroring a broader

Ethereum's next steps – Long-term holder strength vs fall in network activity

Ethereum's long-term holders remain confident, with an average holding time of 2.4 years.

Ethereum 2.4-Year Average Holding Time Signals Confidence From Long-Term Holders – Details

Ethereum (ETH) has surged from $3,050 to $3,400 in less than three days, igniting fresh optimism among investors who believe ETH is poised for significant gains this year. After weeks of uncertainty and selling pressure, Ethereum's latest price action has renewed bullish sentiment, with analysts predicting further upside.

Outspoken Crypto critic slams Ethereum's leadership as ‘dictatorial,' says Solana is “eating its lunch”

Ethereum's (ETH) leadership is to blame for the blockchain's declining fortunes. That's according to one of the platform's fiercest critics, Cyber Capital's founder and CIO, Justin Bons.

Pro-XRP Lawyer John Deaton Shares Take on XRP Displacing Ethereum

Many proponents of Ethereum (ETH) are beginning to realize how possible it might be for the coin to be displaced as the second-largest cryptocurrency by market cap. Breaking the silence on this growing debate is pro-crypto lawyer John Deaton, who noted the possibility that XRP is a prime candidate to displace ETH.

Ethereum Price To $2,000 Or $6,000? Analyst Examines Ether's Future Trajectory

The Ethereum price performance was quite disappointing in the final weeks of 2024, struggling beneath the $3,500 level. This end-of-the-year blues somewhat flowed into the altcoin's action in the first month of 2025, as it failed to build any serious momentum in the first 30 days of the year.

Ethereum Price Eyes $5,000 in February—Is a Massive Rally on the Horizon

Ethereum's price has struggled to gain momentum in 2024 and early 2025, leaving investors frustrated. While Bitcoin has managed to climb 8% since the start of the year, Ethereum has lagged, currently sitting at a minor 1.4% loss.

Solana vs Ethereum – Here are some key insights on the SOL/ETH ratio

Assessing SOL's recovery odds against ETH after its latest 25% dip.

Deaton Predicts XRP Could Overtake Ethereum

Attorney John Deaton has expressed strong optimism that XRP could surpass Ethereum, potentially becoming the second-largest cryptocurrency in the market. In his recent appearance on the Thinking Crypto Podcast, Deaton shared his thoughts on the growing influence of cryptocurrencies, particularly in the wake of Wall Street's increasing involvement in the space.

Ethereum Price Forecast – Can ETH Reach $15,000 Amid Lightchain AI's Buying Momentum?

With the market heating up in 2025, Ethereum's price trajectory is gaining further momentum, partly fueled by projects like Lightchain AI that drive innovation in the blockchain space.

Ethereum Price Enters Bullish Expansion, Analyst Reveals How High It Can Go In February

Ethereum is still showing signs of upward momentum if you know where to look. The leading altcoin is now in a bullish expansion phase, with analysts predicting that its price could surge past key resistance levels in the coming weeks.

Ethereum Technical Analysis: Key Levels and Market Sentiment

Ethereum (ETH) has recently broken out of a bullish falling wedge pattern that has been forming since November 2024, causing a noticeable shift in market sentiment. If the price of Ethereum continues to hold above the critical $3,400 mark, it could see a potential surge of 20%, reaching levels as high as $4,100 in the coming weeks.

Ethereum Price Analysis: ETH Risks Falling Below $3K After Recent Rejection

Ethereum experienced a surge this week, briefly breaking above a key resistance region. However, it lacked sufficient momentum, appearing to be a false breakout.

Ether Whales Lead Altcoin Accumulation as Prices Inch Forward

Ethereum whales have resumed large buys as bulls set sights to regain lost ground. Bitcoin and other assets saw similar positive figures amid a wider crypto market recovery.

$4000 For Ethereum? Here's Why it's Not Impossible

Ethereum (ETH) is currently in a complex phase, caught between a decline, poor performance, and a critical resistance level. Currently, ETH is trading around $3,241, which is a drop of about 33% from its all-time high!

Grabbing This Coin at $0.175 Could Be a Bigger Bet Than Buying Ethereum (ETH) at $10

Imagine buying Ethereum (ETH) at $10, which made early adopters millionaires. Rexas Finance (RXS),

Vitalik Buterin Doubles Down on Ethereum as He Reveals Bitcoin Holdings

Ethereum's co-founder Vitalik Buterin recently shared insights into his crypto portfolio, revealing a minimal investment in Bitcoin—less than 10%.

Largest Swiss Bank UBS Tests Its Product on Ethereum's L2 ZkSync

UBS, a Swiss-based banking and asset managing conglomerate, is experimenting with rolling out Key4 Gold program on zkSync Validium testnet. In a bold move, UBS is setting new standards in RWAs tokenization on Ethereum-like blockchains.

Ethereum's price falls and sees red, but buying activity might say otherwise!

Could a potential breakout be next for the world's largest altcoin?

Ethereum Gains, But Struggles Above The $3,400 Support Level

Cryptocurrency analysts of Coinidol.com report, after the current rally, the price of Ethereum (ETH) has broken through the 21-day SMA.

Swiss Banking Giant UBS Brings Gold Trading to Blockchain With Ethereum

Swiss banking giant UBS has successfully tested its UBS Key4 Gold product on ZKSync, an Ethereum Layer-2 network.

Ethereum Price Forecast 2025–2030: Strong Growth Ahead

Ethereum's future remains a hot topic among crypto enthusiasts, with analysts offering a range of price predictions for the coming years. The current price of Ethereum stands at approximately $3,354, but many experts believe its price could soar significantly by 2025 and beyond.

Ethereum Flashes Bullish Divergence – Is A Rally On The Horizon?

The price of Ethereum (ETH) has shown some significant change in the past day rising by 1.86%. However, according to trading data from CoinMarketCap, the popular altcoin has recorded negative growth since December 2024 despite some significant gains in the past month.

Bitcoin's Limited Upside vs Ethereum's Strong Growth Potential

A prominent crypto analyst, known on social media as CredibleCrypto, has shared his market outlook for Bitcoin (BTC) and Ethereum (ETH), offering insights that suggest Bitcoin's growth potential may be limited compared to Ethereum in the upcoming cycle. CredibleCrypto, who boasts over 460,000 followers on platform X, has been tracking Bitcoin's price movements and believes that while the crypto king has shown some positive signs during its recent period of sideways consolidation, its upside potential in this cycle might not be as significant as that of other major digital assets.

Ethereum (ETH) Struggles Below $4K as Whales Stack Up Solana (SOL) and This Low-Cap AI Coin Below $0.1

The crypto market's underwhelming performance continues, although a bounce is anticipated in the coming days or weeks. Ethereum's (ETH) struggle below $4,000 persists, sparking concerns. On the bright side, the current price presents a good entry. Meanwhile, whales have been stockpiling Solana (SOL) and IntelMarkets (INTL), a low-cap AI crypto.

Solana Price Eyes $300 As PumpFun Founder Explains Why Ethereum Didn't Take Off

Solana price has experienced consolidation, recently bouncing to $241 before correcting to the $230 support level. Despite this, the altcoin is eyeing a $300 target.

Ethereum needs more blockchain activity, adoption, to recapture $4K

Ether faces significant resistance at $3,400, with over $1 billion worth of cumulative leveraged shorts standing to be liquidated.

Crypto Options Expiration Today: Bitcoin & Ethereum Market Impact

A pivotal moment for the cryptocurrency market, as more than $10 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire, creating an environment ripe for volatility. With Bitcoin options totaling $8.36 billion and Ethereum options accounting for $1.94 billion, traders are bracing for price movements that could ripple across the crypto space.

Can Ethereum Price Hit $5,000 in February as ETH Holders Capitulate?

Ethereum price consolidation over the past few weeks, coupled with its lackluster performance in 2024 and 2025, has caused investors to lose hope. However, very few analysts believe that ETH could be ready for a massive uptrend.

Crypto Prices Today Feb 1: BTC Slips, ETH & Meme Coins Surge, QTUM Up 40%

The crypto prices on Saturday have shown mixed actions as broader macroeconomic events unfolded. Bitcoin (BTC) price showcased a waning movement to reach $102K, whereas Ethereum (ETH) and meme coins witnessed an upward intraday action.

Ethereum's leadership battle: Community vs. Buterin's final say

Ethereum Foundation could see leadership changes but Vitalik is the making EF's decisions solely before the reforms materialize.

Trump hype helps Solana flip Ethereum in monthly revenue for the first time

For the first time, Solana posted better monthly revenue stats than Ethereum. SOL, currently trading at $230, generated a revenue of over $116 million in the past month, compared to Ethereum's $107 million earnings.

Ethereum Price Prediction: Is ETH About to Crash Below $3,000?

Ethereum's price has been stuck in a tight range, barely making any moves. Could ETH be gearing up for a major breakdown?

Ethereum Faces Key Support – Price Reversal Possible

Ethereum (ETH) is currently navigating a pivotal point in its price trajectory, with several factors pointing to both short-term caution and long-term potential. Recently, ETH's Market Value to Realized Value (MVRV) ratio dipped below its 160-day moving average, a trend that historically has preceded price corrections.

Bitcoin, XRP, Dogecoin Pull Back On Trump Tariff Announcement, Ethereum Hanging On

Cryptocurrency markets are under pressure on Friday after President Trump's tariff announcement. Cryptocurrency Price Gains +/- Bitcoin (CRYPTO: BTC) $101,924.10 -3.6% Ethereum (CRYPTO: ETH) $3,310.99 +1.5% Solana (CRYPTO: SOL) $228.96 -4.7% XRP (CRYPTO: XRP) $3.01 -4.2% Dogecoin (CRYPTO: DOGE) $0.3245 -3.1% Shiba Inu (CRYPTO: SHIB) $0.0000187 -0.6% Notable Statistics: IntoTheBlock data shows large transaction volume decreasing by 3.6% and daily active addresses growing by 4.3%.

Ethereum Is About To Enter Its Most Bullish Month In History, Here's What To Expect

Amid its underperformance, Ethereum is set to enter its most bullish month in history. This has sparked a positive sentiment among investors, who hope for a bullish reversal.

Uniswap V4 DeFi Protocol Launches on Ethereum and Beyond—Here's What's New

Decentralized exchange Uniswap launched its V4 protocol across Ethereum, Avalanche, BNB Chain, and beyond Friday, with various improvements.

ETH, CRO, FLOKI price update as Tether posts $13B profit

The global crypto market cap stands around $3.58 trillion, down by 0.13% in the past 24 hours at the time of writing. Daily trading volume for the entire market fell 22% to around $107 billion in this period. According to CoinMarketCap, Bitcoin dominance was at 57.

Uniswap v4 Goes Live: Expands DeFi Capabilities Across Ethereum and L2s

In an astonishing development, decentralized crypto exchange (DEX) Uniswap has unveiled Uniswap v4, transforming the protocol into a comprehensive platform for developers. Uniswap v4 is now live and operational across multiple platforms, with exchange functions launched in a few days.

Vitalik Buterin reveals his portfolio exposure to Bitcoin and ‘anything that is not ETH'

Ethereum (ETH) co-founder Vitalik Buterin has weighed in on the ideal portfolio allocation debate, revealing that his Bitcoin (BTC) holdings fall below 10%. His comments come as ETH rises more than 3%, reigniting discussions on optimal cryptocurrency portfolio allocation.